Key Benefits

Bank Your

Performance

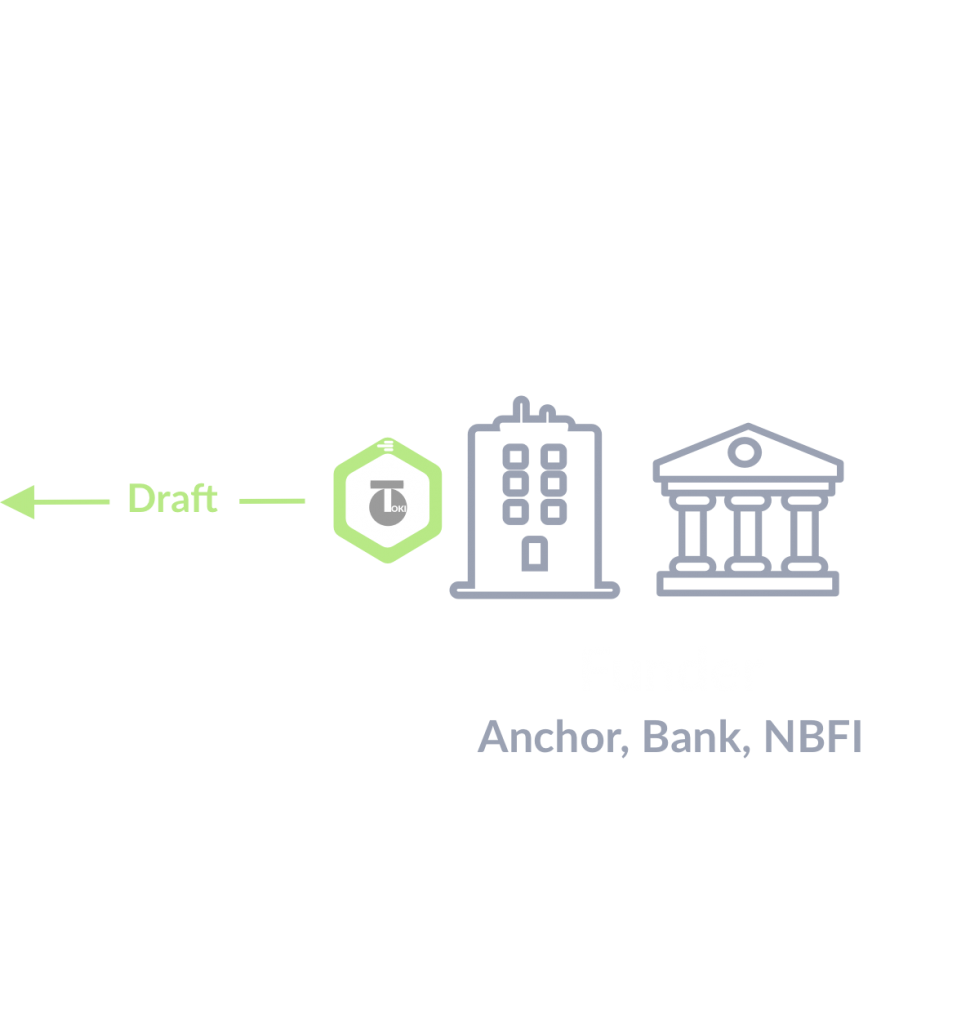

Tallyx will tokenize your corporate identity and accurately reflect your supply chain performance through a reputation score, ultimately lowering your cost of finance.

Benefits of anSCF program

You can use our digital draft, not just as a cash flow tool, but also to negotiate with your trading partners. Use our digital draft to extend payment terms with your upstream suppliers.

Instant

Cash

Convert receivables to cash on demand at reasonable rates of interest via just three clicks.

One Portal

Many Funders

Our 1Globe platform ensures that you can work with multiple buyers and multiple funders through a single portal for all of your receivable financing needs.

More

Choice

An inclusive and borderless marketplace that offers your business a variety of working capital options, coupled with the ability to further fund your upstream suppliers