STIMULATE THE ECONOMY

Targeted Stimulus Program to Effectively Bring Relief to Desperately Needed SMEs in Times of Covid-19

EVERYONE BENEFITS

Significant Upsides, with a Domino-like Effect

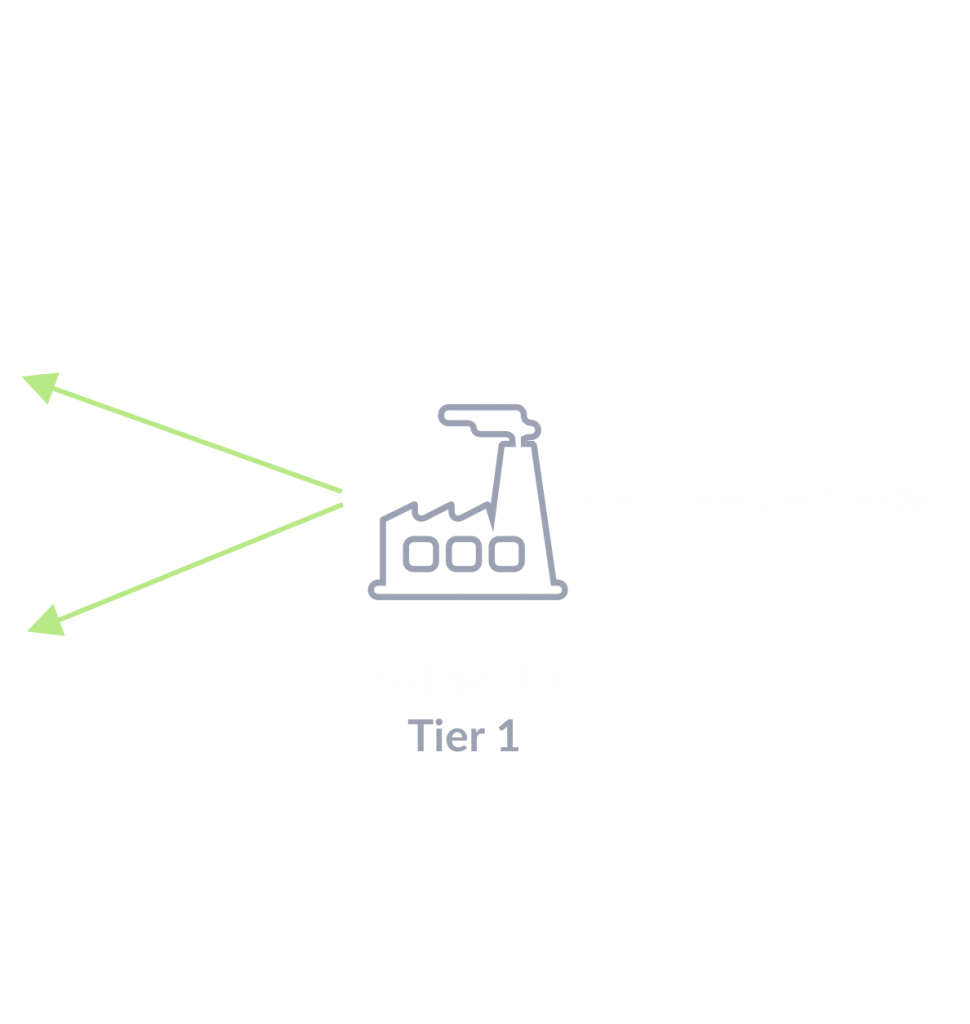

Stimulus funds can be provided through Anchor’s Early Payment program, in the form or cash or digital draft, ensuring all players in a given supply chain can benefit.

Stabilizing

Economy

SEDA works by targeting specific industries and injecting relief funds effectively through anchors deep into their supply chain, reaching the many SMEs desperately seeking help and thereby averting the economy from sinking into a depression.

Transparency,

Low Overhead

SEDA requires minimal administration overhead while offering greater transparency into the use of funds, which is critical for the success of any stimulus program while ensuring accountability to the overall supply chain.

Speed, Efficiency in

Stimulus Program

Tallyx’s Lite Touch Onboarding of deep tier suppliers is a quick simple onboarding process, in comparison to thelimiting traditional bank-hosted SCF programs, due to onboarding bottlenecks stemming from compliance requirements.

Features

SEDA is an extension to Tallyx’s Early Payment Plus, with the following added features:

Extended

DPO

Extend anchor buyer’s DPO to 180 days

Early

Payment

Alternatively use government-funded SEDA account to fund early payment in lieu of buyer’s own cash.

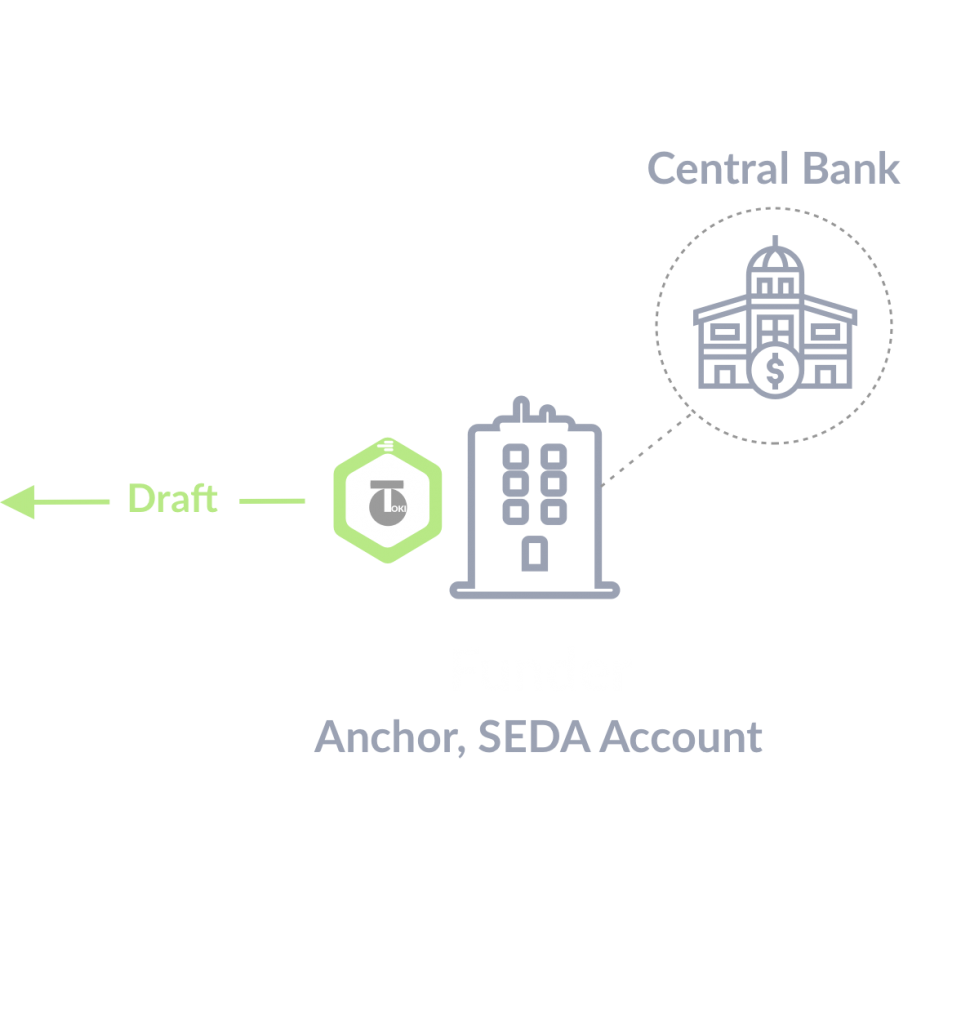

Central Bank

Digital Draft

Instead of using CAPD (Commercial Approved Payable Draft) which is backed by Anchor’s reputation, Central Bank Digital Draft (CBDD) is used, which is backed by Central Bank’s credibility.

Modern

Technology

Easy onboarding and account setup. Funders get access to a much larger pool of fundable assets through better packaging of trade assets and their associated risk that can be afforded by adopting blockchain tokenization and Artificial Intelligence technology.

How it Works

- Early Payment - SEDA

- Central Bank Digital Draft

Early Payment Funded by Government Relief Funds

Anchor Uploads Approved Payables

Perform eligibility check, extend maturity date

(per SEDA Policy)

Supplier Submits Early Payment Request

Discounting Rate per SEDA Policy

Auto-Accept Based on SEDA Policy

Anchor arranges Early Payment using SEDA-backed account, based on info from auto-generated AEP File

Anchor’s Repayment to SEDA account

Remind Anchor to pay down O/S balance of SEDA account at extended maturity dates

Central Bank Digital Draft (CBDD) is a sovereign guarantee by the government to pay the invoices underlying the draft holder on due date.

Anchor Uploads Approved Payables

Perform eligibility check, extend maturity date

(per SEDA Policy)

Supplier Requests CBDD

If approved, Supplier is notified of CBDD issuance in Tallyx Wallet

Supplier’s Options with CBDD

Request discounting of CBDD, use as payment to upstream suppliers, or wait for maturity payment

Anchor’s Repayment to SEDA Account

Remind Anchor to pay down O/S balance of SEDA account at extended maturity dates